Introduction

In 2025, finance and investment apps use AI and automation to help users save smarter, invest wisely, and plan confidently. From budgeting to crypto trading, these platforms make managing money effortless and secure.

1. FinTrack AI – Smart Personal Finance

Category: Budgeting & Expense Tracking

FinTrack AI helps you master your money:

- AI-powered spending insights

- Automatic expense categorization

- Custom savings goals

- Bill reminders and smart budgeting

- Sync with all bank accounts

2. InvestIQ – AI Investment Assistant

Category: Stock & Portfolio Management

InvestIQ makes investing accessible for everyone:

- AI-driven portfolio recommendations

- Real-time market analysis

- Risk and performance tracking

- Auto-invest and rebalance options

- Global stock and ETF access

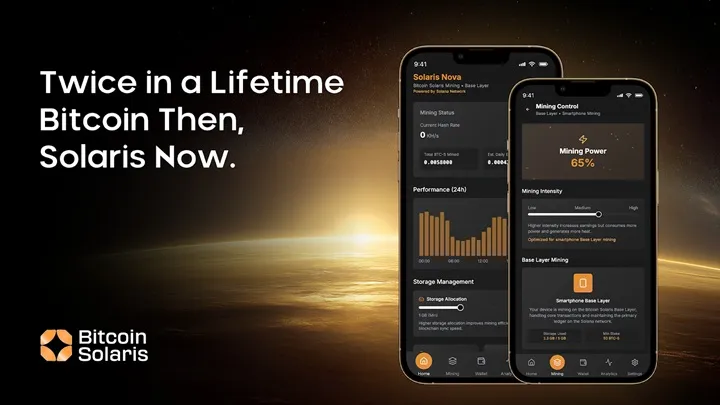

3. CoinVerse+ – Smarter Crypto Management

Category: Cryptocurrency & Web3

CoinVerse+ simplifies digital investing:

- Track and trade crypto securely

- AI alerts for price movements

- DeFi and NFT portfolio integration

- Multi-chain wallet support

- Real-time analytics dashboard

4. WealthPath – Financial Planning Made Simple

Category: Wealth & Retirement Planning

WealthPath helps you plan your future easily:

- AI-based long-term wealth projection

- Retirement and goal calculators

- Expense simulation for major life goals

- Personalized saving strategy

- Connect with certified advisors

5. PayLink – Global Payment & Transfer App

Category: Digital Payments

PayLink makes payments faster and borderless:

- Instant global transfers

- Currency exchange with low fees

- Payment requests and QR scan pay

- Bill split and group wallet feature

- Secure with biometric protection

Conclusion

The Top 5 Finance & Investment Apps of 2025 — FinTrack AI, InvestIQ, CoinVerse+, WealthPath, and PayLink — empower users to save, invest, and manage their wealth smarter with the help of intelligent AI and secure fintech innovation.